How to Calculate Your Military Pension

Although computing a military pension can be difficult, knowing the overall ideas and procedures involved can enable you to make future plans after serving. Given to service personnel who fit specific conditions, a military pension is a type of retirement income. Factors such as years of service, rank, base salary, and retirement scheme determine it.

We will explain how to calculate your military pension in the United States below and provide a thorough analysis of the procedures.

1. Knowing the Criteria

Determining your military pension requires first knowledge of the eligibility requirements. Most service personnel must complete at least 20 years of active service before being eligible for retirement benefits. Your length of service will be a major determinant of your pension in retirement. (Calculate military pension )

Although in some cases—such as for medical reasons—you can retire with less than 20 years of service, the pension you get will be much less than if you serve a full 20 years. Consequently, the foundation of most military pensions is a minimum of twenty years of service.

2. The Retirement Mechanism

Two main retirement systems exist within the American military:

Service members who entered the military prior to January 1, 2018, most often use the High-3 Retirement System. It is based on the average of your top 36 months of base pay—usually the last three years of service.

The Blended Retirement System, or BRS: Designed for service members who joined the military on or after January 1, 2018, this program debuted in 2018. It blends a 401(k)-style retirement savings plan with the conventional pension system so the service member will get both a pension and a government-funded Thrift Savings Plan (TSP).(Calculate military pension ).

Knowing which system fits you will help you decide how your pension is calculated.

3. Base Pay and Its Function in Your Pension

Understanding base pay—that is, your compensation determined by rank and years of service—comes next. It is important to distinguish base pay from allowances such as housing or food, and from special pay such as hazard pay or bonuses. We compute a pension based on the basic wage you accumulate.

The pension under both the High-3 and BRS retirement plans is based on your best 36 months of base pay. Although furthermore, it is possible that another set of three consecutive years could be considered should those years have a higher average pay, normally the last three years of your military employment would be averaged to determine your base pay for pension computations.

Generally, the U.S. military releases base pay tables annually, allowing you to anticipate your salary based on your rank and years of service.

4. The Multiplier for retirement

Your pension’s computation depends mostly on the retirement multiplier as well. Your highest average base pay (over 36 months) determines the multiplier, which varies depending on your military service years.

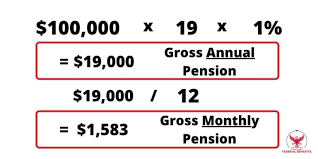

The High-3 system has an easy formula:

Pension = Base Pay Average × Years of Service × 2.5% \text{Pension} = \text{Base Pay Average} \times \text{ Years of Service} \times 2.5%.

For instance, if your highest average base salary is $4,000 a month and you spent 20 years in the military, the computation would be Pension = 4,000 × 20 × 0.025 = 2,000 per month. The calculation for the pension is 4,000 × 20 × 0.025 = 2,000 per month.

Your monthly pension, then, will be 50% of your highest average base pay—20 years times 2.5% equals 50%.

You would add still another 2.5% to this computation for every extra year of service. For example, you would get 75% of your base pay—30 times 2.5%—after serving 30 years.

While using the same 2.5% multiplier for active-duty service, the Blended Retirement System (BRS) also includes a TSP (Thrift Resources Plan), therefore augmenting your retirement resources. You can contribute to your TSP under BRS; the government will match your contributions up to a specific level. This scenario implies that in addition to your pension, you could have a developing retirement savings account.(Calculate military pension ).

5. Other Thoughtfulness

Although the underlying formula for computing military pensions is rather simple, several other elements might affect the ultimate value of your pension. These consist of

COLA: Cost of Living Adjustments

Military pensions typically undergo annual inflation adjustments using Cost of Living Adjustments (COLA). This ensures that the purchasing power of retired military members remains stable over time, as inflation can devalue fixed income. Changes in the Consumer Price Index (CPI) guide COLA increases; pension holders will thus experience regular increases to their monthly salary.

Retirement From Disability

If a service-connected disability forces you to retire, you may qualify for a disability pension instead of a regular retirement income. Under these circumstances, the pension calculation can change. Rather than your years of service, the government can apply a formula based on your disability rating from the Department of Veterans Affairs (VA). A serviceperson with a 50% disability rating, for instance, could get 50% of their base salary as a disability pension.

Benefits of Survivor

You can choose to enroll in the Survivor Benefit Plan (SBP) if you are married and want to provide your spouse some of your pension upon your death. Once you die, this arrangement pays your chosen beneficiary monthly. But going with this strategy will lower your monthly pension.

Taxes

Although some states grant tax exemptions or discounts for military pensions, they are normally subject to federal income tax. When figuring your possible pension, you must take tax effects on your retirement income into account.

6. Calculation Example

To help us see how everything fits together, let’s walk through a thorough example of applying the High-3 Retirement System.

The scenario is 25 years of service.

Over the past 36 months, your best average base wage was $5,000 a month.

You leave with the Master Sergeant (E-8) rank.

To begin, please determine your years of service.

In this case, the individual served for twenty-five years.

Second: Discover Your Base Pay

Your base compensation averages $5,000.

Third step: use the retirement multipliers.

Two and five percent annually of service is the formula. Your multiplier is 2.5%×25=62.5%, given your 25 years of service. 2.5\% \times 25 equals 62.5\%.

Fourth step: figure your monthly pension.

We now times the base compensation by the retirement multiplier:

5,000×62.5%=3,125,000. 5,000 \times 62.5\% = 3,125,000.

Your monthly pension would be $3,125.

Fifth step: Think about COLA and taxes.

You will also need to consider taxes, and your pension may need to be adjusted annually for inflation. Should you choose survivor benefits, your pension may be somewhat less to pay those benefits.

7. Restatement

Calculating a military pension requires knowledge of your years of service, basic pay, and retirement system, as well as consideration of elements such as cost-of-living adjustments, taxes, and survivor benefits. Knowing how the system operates helps you to better prepare for your retirement and guarantees that you will grasp the financial gains following your military career. Whether you are getting ready under the Blended Retirement System or for a conventional pension, it is imperative to compile as much data as you can so you make a wise choice for your future.