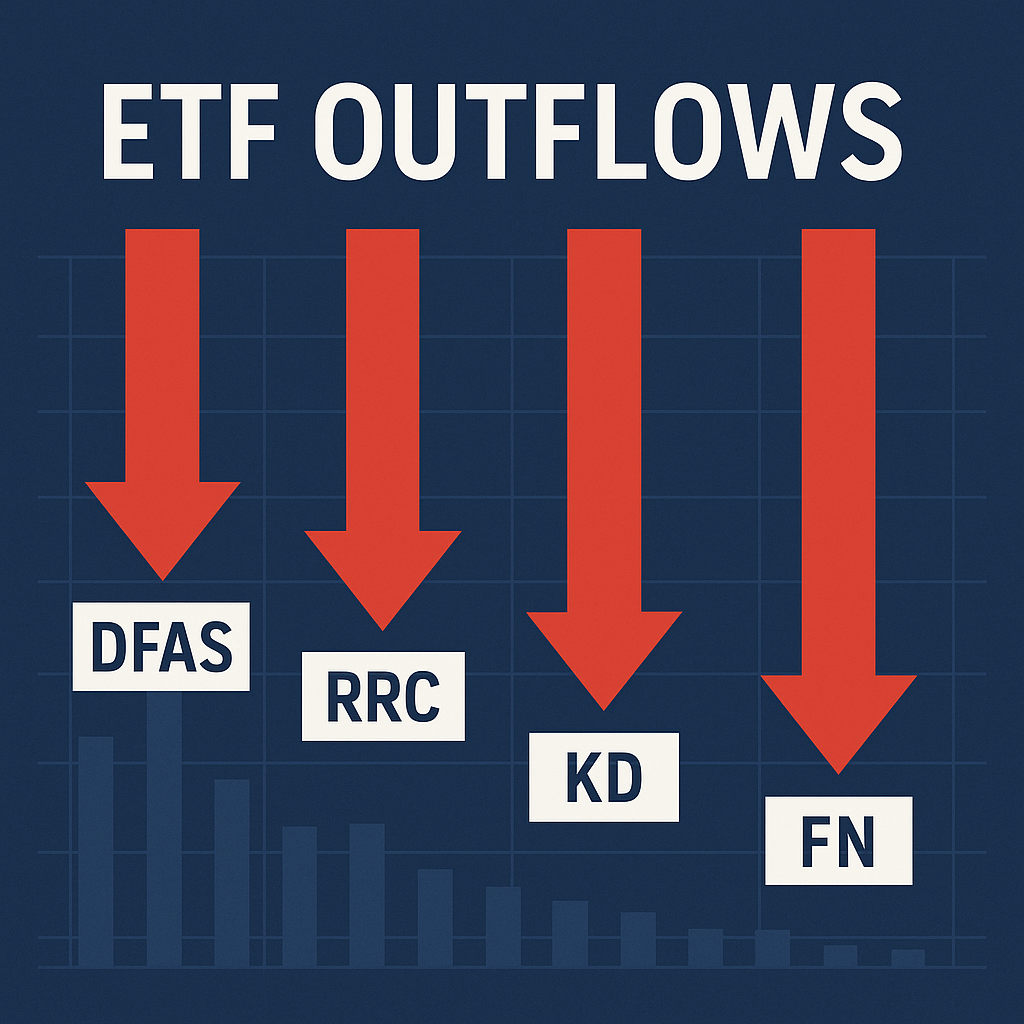

📰 Major Outflows Detected in DFAS, RRC, KD, and FN ETFs

📅 Date: June 28, 2025

📈 Market Focus: ETF Sector Movement

🧾 Tickers in Focus: DFAS, RRC, KD, FN

Large institutional outflows have been observed across several prominent ETFs and equity holdings, including Dimensional US Small Cap ETF (DFAS), Range Resources Corp (RRC), Kyndryl Holdings Inc. (KD), and Fabrinet (FN). These movements may signal a shift in investor sentiment as macroeconomic pressures and interest rate volatility continue to shape the broader markets.

📊 ETF Outflow Summary:

| Ticker | Company / ETF Name | Notable Movement |

| DFAS | Dimensional US Small Cap ETF | High volume outflows |

| RRC | Range Resources Corporation | Sudden institutional sell-offs |

| KD | Kyndryl Holdings Inc. | Downtrend amid low volume |

| FN | Fabrinet | Persistent capital outflows |

🔎 What Does This Mean?

These large outflows indicate that investors may be rotating capital out of small-cap and mid-tier holdings into more defensive or large-cap assets. Specifically:

- DFAS, which targets U.S. small-cap equities, might be experiencing pressure from rising interest rates or risk-off sentiment.

- RRC and FN, both tied to cyclical or growth-sensitive industries, could be facing profit-taking or hedge fund repositioning.

- KD, a tech services firm, might be under pressure from weakening enterprise demand signals.

🧠 Investor Insight:

Outflows don’t necessarily mean poor performance — they often reflect portfolio rebalancing, sector rotation, or profit-locking during market volatility. However, tracking these flows can help investors make better short-term or sector-based decisions.

✅ Stay Updated:

For ongoing analysis of DFAS and related ETF activity, follow updates on dfas.blog, where we track:

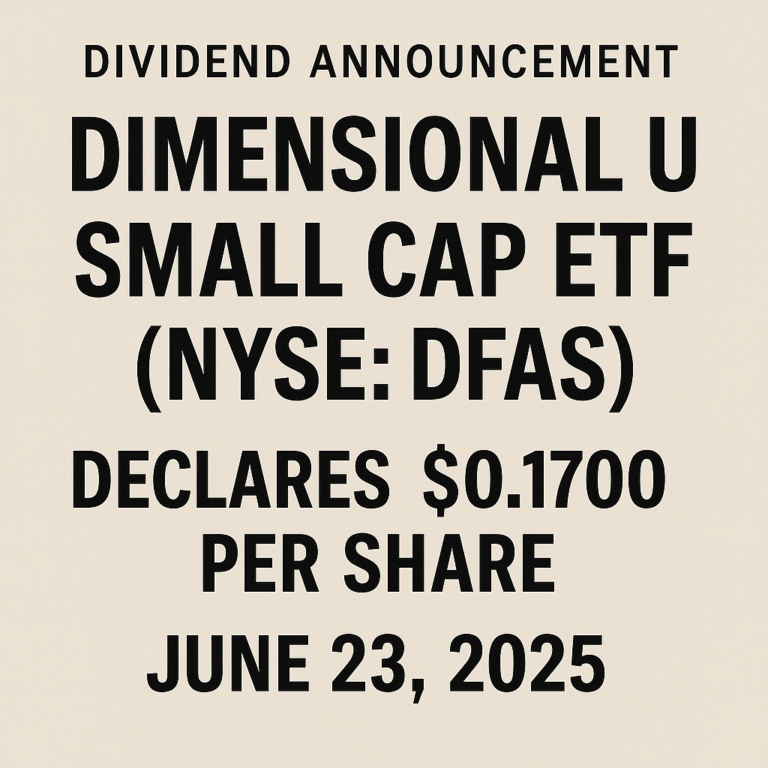

- Dividend declarations

- Institutional movements

- ETF inflows/outflows

- Performance comparisons