Dimensional U.S. Small Cap ETF: Dividend Growth Amid a Challenging Landscape

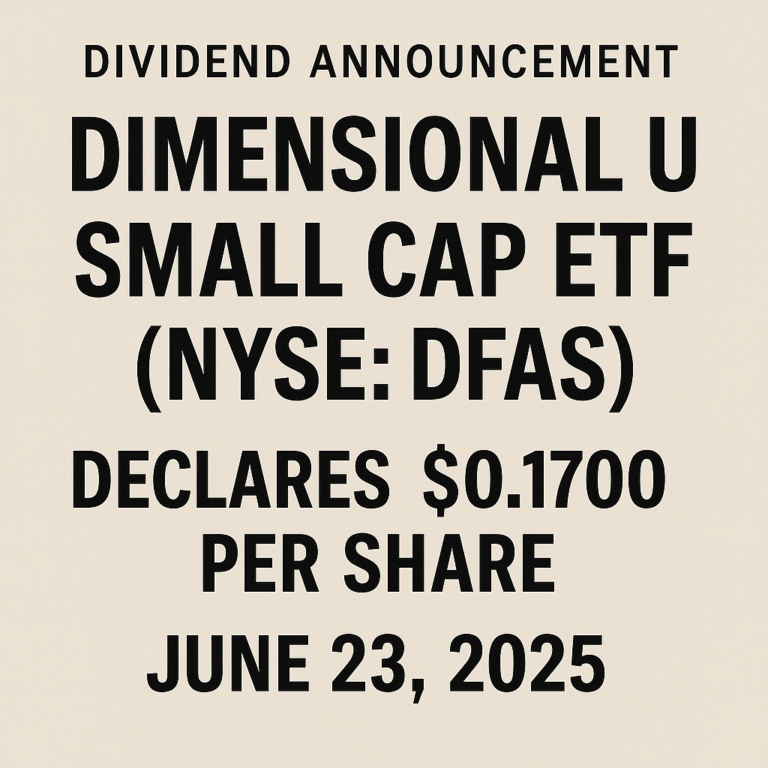

The Dimensional U.S. Small Cap ETF (DFAS) has recently increased its quarterly dividend by 28.28% to $0.1701 per share. Reflecting the resilience of small-cap equities amid volatility1. However, investors should consider the broader challenges for U.S. small-cap companies. Including trade policy uncertainty, inflationary pressures, and slowing economic growth. The ETF’s holdings are concentrated in sectors like Financials, Industrials. Technology, which are cyclical and vulnerable to trade policy disruptions. While the dividend growth is a positive development, it must be weighed against the potential risks.

Dividend Growth:

The significant increase in DFAS’s quarterly dividend highlights the ETF’s ability to generate income amid market challenges. This growth is a positive signal for income-focused investors, indicating the resilience of small-cap equities in generating dividends1.

Sector Concentration:

The ETF’s holdings are concentrated in sectors that are sensitive to economic cycles, such as Financials and Industrials, which are exposed to downturns. However, the inclusion of Technology, with its innovation-driven growth potential, could provide a buffer against sector-specific risks1.

Market Conditions:

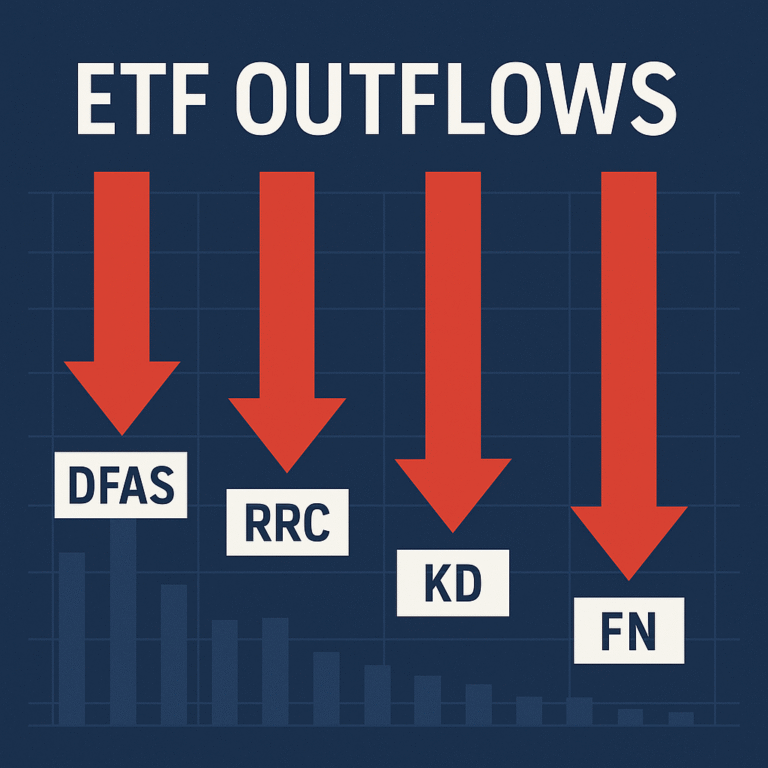

The U.S. small-cap sector has underperformed large caps in 2025, with a decline of nearly 6% year-to-date through June. High interest rates, squeezing small businesses with debt-heavy balance sheets, and a slowdown in services spending are current challenges. However, volatility can present buying opportunities for investors with a long-term horizon1.

Dividend Sustainability:

While the recent dividend hike is a positive sign, investors should monitor the sustainability of these dividends, especially in light of the broader economic challenges facing small-cap companies. The ETF’s ability to maintain consistent quarterly distributions despite sector shifts and macroeconomic headwinds underscores its commitment to income generation3.

In conclusion, the Dimensional U.S. Small Cap ETF offers a compelling opportunity for income-focused investors, particularly those willing to consider the volatility and challenges of small-cap equities. The recent dividend growth is a positive development, but it must be evaluated in the context of the broader market conditions and the ETF’s sector concentration. Investors should remain cautious and consider their investment horizon when evaluating this ETF.

💰 How have the dividends of the ETF changed over the past year?

The dividends of the Dimensional U.S. Small Cap ETF (DFAS) have shown variability over the past year. Here’s a summary of the dividend distribution plan for the last four months.

As shown, the ETF has experienced fluctuations in its dividend per share, with the highest dividend being $0.18 USD in December 2024 and the lowest at $0.13 USD in March 2025. The recent increase to $0.1701 per share represents a significant shift and a positive development for income-focused investors. However, it’s important to consider the broader economic conditions and the ETF’s sector concentration when evaluating the sustainability of these dividends.

🚀 Are there any upcoming dividend announcements for the ETF?

There are no upcoming dividend announcements for the Dimensional U.S. Small Cap ETF (DFAS) in the third quarter of 2025. The most recent dividend was paid on June 26, 2025, and was $0.1701 per share.

However, investors should note that the ETF has a history of quarterly dividends and may announce future dividends outside of the third quarter. It’s important to monitor the ETF’s dividend distribution plan and any announcements from Dimensional Financial for updates on potential future dividends.

💰 What is the current dividend yield of the ETF?

The current dividend yield of the Dimensional U.S. Small Cap ETF (DFAS) is approximately 1.00%.

⚖️ What is the historical average dividend yield of the ETF?

The historical average dividend yield of the Dimensional U.S. Small Cap ETF (DFAS) over the past year is approximately 0.95%.

This average dividend yield is calculated by taking into account the dividend yield of the ETF at various points in time over the past year. It is important to note that this average yield may fluctuate over time due to changes in the ETF’s dividend distribution plan and the performance of the underlying small-cap stocks.