Fiscal Cliff Legislation Affects Military, Civilian Paychecks

Introduction

The fiscal cliff—a term used to describe a combination of expiring tax cuts and across-the-board government spending cuts—has significant implications for both military and civilian federal employees. As lawmakers struggle to reach agreements to avoid deep budgetary impacts, changes in federal tax policies and spending have directly affected the take-home pay of millions of Americans, particularly those serving the country in uniform or working in federal agencies.

This article explores the effects of fiscal cliff legislation on military and civilian paychecks, explaining how the economic and political landscape has altered tax rates, benefits, and overall compensation.

What Is the Fiscal Cliff?

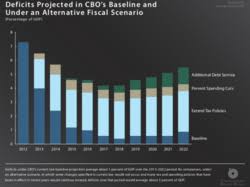

The term “fiscal cliff” refers to a set of financial measures that were set to go into effect at the end of 2012 (and have continued to resurface in various forms since). These included:

- Expiration of the Bush-era tax cuts

- Automatic across-the-board budget sequestration cuts

- Expiration of temporary payroll tax cuts

- Changes in unemployment benefits

- Scheduled Medicare payment reductions

In essence, if Congress had not intervened, these factors would have led to significant tax increases and spending cuts, pushing the economy toward a potential recession.

Impact on Military Personnel

1. Paycheck Reductions

For service members, the expiration of the payroll tax holiday (which temporarily reduced Social Security taxes from 6.2% to 4.2%) meant a 2% decrease in take-home pay starting in 2013. For example:

- A military member earning $40,000 per year lost about $800 annually.

- Higher-earning officers saw even greater reductions.

This rollback was automatic and immediate, appearing in the first paychecks of the new fiscal year.

2. Base Pay Raises

Although military members received modest base pay increases (e.g., 1.7% in 2013, 1.6% in 2024), these raises were often overshadowed by higher tax burdens and inflationary pressures. The overall net benefit of these pay increases was minimized due to rising costs of living and lower net income after taxes.

3. Threats to Hazard Pay, Special Pays, and Bonuses

During debates over budget control and deficit reduction, many special military compensation categories—such as:

- Hazardous duty pay

- Reenlistment bonuses

- Family separation allowances

…were under scrutiny for potential cuts. While most were preserved, the uncertainty itself created financial stress for military families.

Impact on Civilian Federal Employees

1. Pay Freeze Extensions

One of the immediate impacts of the fiscal cliff and its surrounding budget deals was the continuation of a federal pay freeze for civilian workers. From 2011 through early 2013, federal employees received no across-the-board raises. Though steps were taken to lift the freeze later, any increases were marginal and often eroded by increased health insurance premiums and reduced take-home pay.

2. Increased Retirement Contributions

To cut deficits, new federal employees were required to contribute a higher percentage of their salaries to the Federal Employees Retirement System (FERS):

- Pre-2013 employees contributed 0.8%.

- Post-2013 hires were required to contribute 3.1% or more.

This policy reduced disposable income for newly hired federal workers and effectively created two tiers of benefits.

3. Threat of Furloughs

In response to sequestration cuts, agencies across the federal government initiated civilian furloughs, which were:

- Unpaid days off (typically 1 day per week or per pay period)

- Aimed at reducing agency expenses

- Applied to thousands of workers, especially in defense-related departments

For many employees, this amounted to a 20% pay cut during furlough periods, with long-term financial and morale impacts.

Broader Financial Implications

1. Reduced Consumer Spending

The combined effects of higher taxes, less disposable income, and delayed raises resulted in lower consumer spending. This was especially true in areas with high concentrations of federal employees and military bases, where local economies rely heavily on federal paychecks.

2. Financial Planning Strain

Many military families and federal workers had to adjust their household budgets, cutting back on non-essential expenses and delaying large purchases. Emergency funds became more important, and credit card use increased for some to cover basic costs.

3. Long-Term Trust Issues

The repeated use of federal employees and service members as bargaining chips in budget negotiations caused many to lose trust in political leadership. Many viewed the ongoing uncertainty around pay and benefits as a sign of instability in their employment.

Response from Lawmakers and Agencies

Lawmakers faced significant pressure from military advocacy groups (like MOAA) and federal employee unions (like AFGE) to protect pay and benefits.

Actions Taken Included:

- Restoring portions of pay affected by furloughs.

- Advocating for back pay during government shutdowns.

- Working to secure cost-of-living adjustments (COLAs) in future years.

- Promoting legislation to shield military and civilian workers from being impacted in future budget standoffs.

Recent Developments (2025 Context)

In the current fiscal year (2025), military and civilian pay has stabilized somewhat, but:

- Inflation has eroded much of the modest pay increases.

- Healthcare premiums under FEHB (Federal Employees Health Benefits) have increased by over 7% for some plans.

- Thrift Savings Plan (TSP) performance has been mixed, affecting retirement savings.

With rising geopolitical tensions and a larger defense budget, military spending remains a priority, but ensuring fair compensation for those serving is still a key issue in Congress.

Advice for Affected Personnel

1. Review Pay Stubs Carefully

Watch for any unusual deductions or changes in gross/net income.

2. Plan for Tax Adjustments

Withholding levels may have changed—consider consulting a tax professional or using the IRS withholding estimator.

3. Maximize TSP Contributions

Ensure you’re taking full advantage of TSP matching and Roth options for long-term savings.

4. Build Emergency Funds

Budget for uncertainty—having 3–6 months of expenses saved is vital, especially during furlough-prone times.

Conclusion

The fiscal cliff legislation has had a lasting impact on military and civilian federal workers. Though some effects were temporary, the broader pattern of uncertainty and reduced pay growth continues to shape the financial lives of those who serve. Staying informed, planning ahead, and advocating for fair treatment remain essential for navigating the complex landscape of federal compensation.